Applying for CPP

The most painful online experience

So like most people, I have parents and well my parents- bless their live-in-the-boonies of Northern Ontario hearts- are not exactly technophiles. My 70 year old Dad can now text, which was a weird day when I got a text from a random cell number I didn’t even know existed.

As my Mom approaches 70, she finally decided it was time to collect her CPP (Canada Pension Plan) and OAS (Old Age Security). She always said it would impact her taxes getting it earlier but she was also making like $12,000 a year so {shrugs}

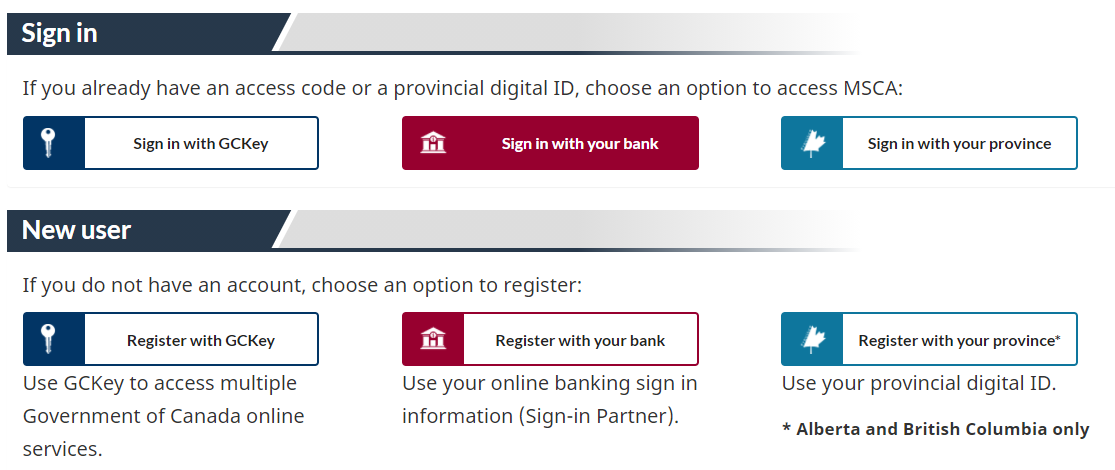

The task fell to me to help do this for her. Now many of you have had the pleasure of dealing with the Government’s online system but if you have never signed up for MyCRA or ServiceCanada let me tell you this. It’s like it was made in Commodore 64 days. I mean look at this glorious system.

Like a normal person, I am sitting there with the elder Rooks and so I click the Bank option. Clickety-click and I think I have done the job using their online banking info. But fuck no. They need to send me a super secret access code via their best buds at Canada Post. You can imagine what postal delivery in rural Northern Ontario is like in late November.

Defeated, I head home with everything I need to do this once the magic code has arrived. Which it does about 10 days later. Two factor authentication anyone?

Aside: One of the most debated topics for retirees is the “When do I take it?” question around CPP. The standard age in the calculation is 65 but you can take it as early as 60 but that comes with a significant reduction in your annual payments (36% less per year). According to this study from Bonnie-Jeanne MacDonald of Ryerson’s National Institute on Ageing, 95% of Canadians start taking CPP at age 65 or earlier. Here’s the issue with that though, CPP increases payments if you delay. If you can hold out until 70, then your CPP payments are 42% larger each month. Since CPP is also indexed to inflation (or whatever shitty measure we use for inflation) a 2% annual increase means a lot more cash on a CPPer that waited to age 70. In the end, unless you absolutely need the cash up front…delaying as long as possible makes a world of difference.

Now armed with the access code I signed in and called up my parents to do the finishing touches on this application. It’s a simple enough process once you can get into the club. Do you want taxes withheld? Can they email you the tax slips? (yep, CPP is taxable). Can you give us your address? Add a phone number here so we can call you. No seriously add your phone number. Sorry the add the phone number resource isn’t working right now. No we don’t know when it will be fixed but go ahead and try it for two solid weeks. You can imagine how much fun it is to fill out all the important info to help your mother start taking her CPP only to get bogged down on a trash piece of code around a phone number.

After two weeks of trying and getting the same error, Service Canada finally found the modern world and added a fillable form to have someone call my parents back to help with this error message. Only a 2 day wait too!

So after a dutiful wait of 2 days, I get back on the phone and get everything reviewed. It was a few clicks and verifying information with my mother and she okays me to hit the submit. CPP is now done and now she waits until the end of December for the first payment to be deposited into the bank.

I had spoken to many people before about when to apply for their own CPP. Having gone through it was a real eye-opener. The online system was a shambles but in the last couple of weeks it improved. Heck they even have 2FA now.

What is needed though is a real upgrade to how we plan for the CPP. At no point did I see any information on the estimated payment my mother would get each year. Adding her SIN number was part of the application info -surely her CPP payment info can be added fairly seamlessly. Even better, using the research of Bonnie-Jeanne MacDonald, why not add in a calculator to show the impact of delaying payments before you make your selection? Think of the benefit to all Canadians to have a clearer picture of what that means to their retirement cash flow?